Alright, so let’s talk gold—because, let’s face it, it’s all anyone seems to care about these days. Whether it’s the turmoil in the markets, geopolitical uncertainty, or the looming threat of inflation, gold seems to be one of the few things that has managed to keep its cool. But is it a safe haven, or are we just staring at another bubble waiting to pop?

Let’s break this down. Gold’s been climbing in value, and while that might seem like a good sign for investors, we need to dig a bit deeper to understand why it’s happening, and—most importantly—what’s really driving this uptrend.

Gold’s Current Trend: Up, Up, and Away?

Here’s the thing: gold has been rallying lately. You’ve probably noticed, right? Early on Monday, the market saw a pretty significant push, and if you’ve been paying attention, you’ll see that it’s just continuing the move from Friday’s gains. We’re talking about a classic “hammer” pattern here—don’t worry, it’s not as fancy as it sounds. It’s basically a sign that the market is picking up steam after a bit of a dip. In technical analysis, this is often seen as a sign that the price is about to rise.

But, here’s the catch: while the market is clearly in an uptrend, don’t get too comfortable. You might want to look at the 50-day Exponential Moving Average (EMA). Why? Well, for one thing, it’s sitting at around $2,800 right now. This level is key because it’s not just any random number. It’s a psychological barrier for investors, and we’ve seen it act as both resistance and support in the past.

If gold can stay above that 50-day EMA, it’s going to give the market a strong foundation to build from. But, if it dips below, well, let’s just say the “gold rush” might start to feel more like a stampede of people running for the exit. And we don’t want that, do we?

The $3,000 Target: Will Gold Hit the Mark?

The big question that everyone’s asking: will gold hit $3,000? It’s a nice round number, isn’t it? Feels like a goal worth chasing. But let’s not get ahead of ourselves here. While we’re definitely in an uptrend, the road to $3,000 isn’t going to be a smooth ride. There’s a fight on our hands. Expect some choppy market movements. Think of it like a boat on the open sea—sometimes it’s calm, sometimes it’s a bit rough.

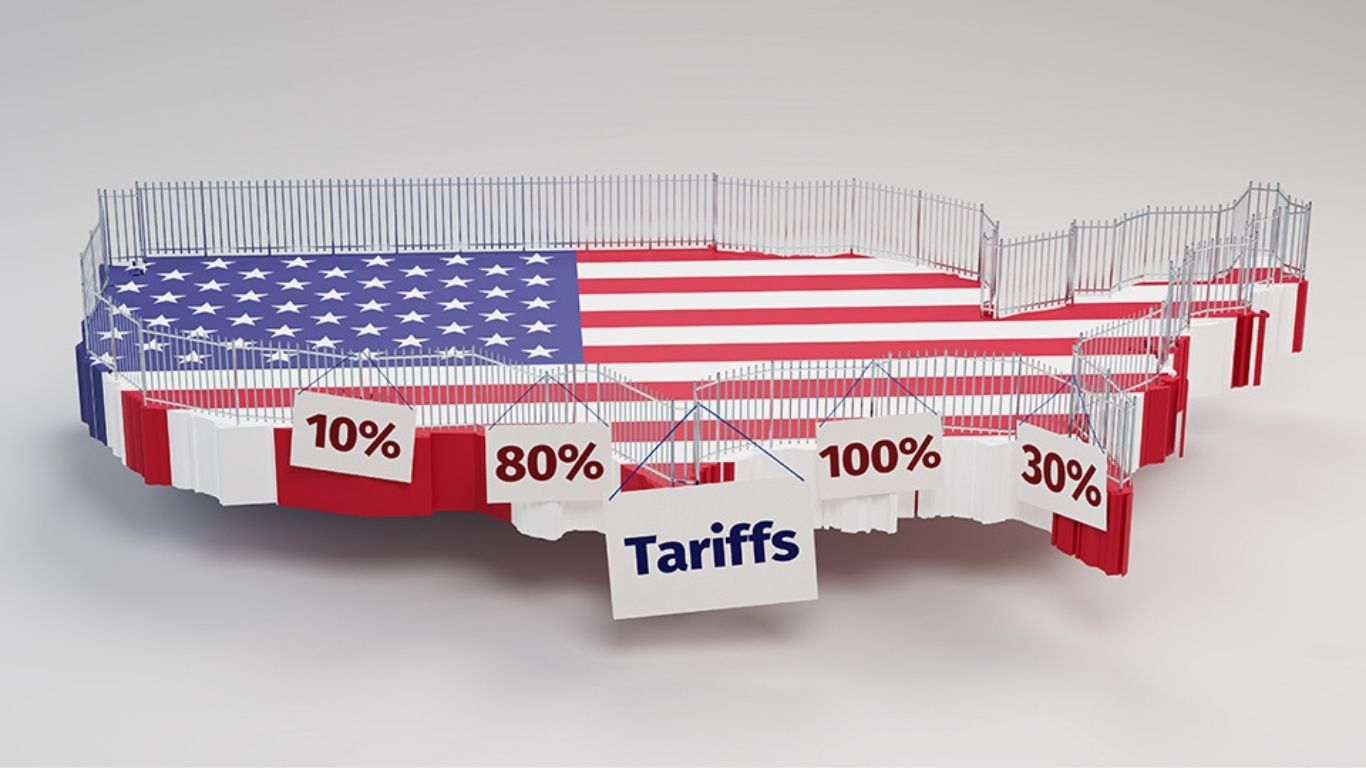

Why the turbulence? Well, geopolitical risks, potential tariffs, and all sorts of economic headaches are still in the air. But here’s the thing: gold doesn’t care much about the drama. It’s always been a go-to asset in times of uncertainty. So, while we might see some market jitters in the short term, gold is likely to stay in demand. After all, when the world feels like it’s on the edge, gold is the cozy blanket investors pull out from under the bed.

Gold: A “Buy” in a World That’s Far from Safe

Now, I know what you’re probably thinking: “So, does this mean I should be buying gold?” The simple answer? Probably. I mean, come on, are things looking any less shaky out there? The world’s still a mess, and unless something changes (and who knows if it will), gold looks like it’s in the clear for now.

Let’s put it this way: I’m not about to tell you to short the gold market anytime soon. That would be like betting against a tidal wave—you’re better off getting out of the way and riding it. The trend hasn’t changed; if anything, it’s picking up steam.

A Long-Term View: Patience Is Key

So, where does that leave us? In short, patience is key. Sure, we might see some fluctuations—gold markets are nothing if not volatile—but in the grand scheme of things, it’s still trending upwards. And as long as the geopolitical tensions and economic instability continue to hang around, I wouldn’t be betting against gold.

Think about it: If you’re looking to park your money in something with a bit more safety, gold has always had a way of weathering the storm. And right now, with the world feeling a little less stable, that doesn’t look likely to change any time soon.

Is Gold a Sure Thing?

Look, is gold a guaranteed win? No. There are no guarantees in the market, as anyone who’s been burned by a bad investment can tell you. But right now, given the current climate, gold’s one of the better bets. The world’s in a bit of a mess, and in times like this, people turn to gold.

For now, keep an eye on that $2,800 level. If it holds, we could see gold make a serious run at $3,000. But if it doesn’t, well, let’s just say we might want to brace for some rough seas ahead.

So, while the gold market might not be for the faint of heart, it’s certainly got a lot of potential—especially when the rest of the world is looking a little shaky. As they say, “In gold we trust”—and right now, it’s hard to argue with that.