Recession Warnings: Whispers Turn into Alarm Bells

The world economy is at the perilous intersection. Over the past few weeks, a sequence of U.S. tariffs against Canada, Mexico, and China—met with prompt retaliation—has jolted financial markets into expectations that a recession is imminent. U.S. President Donald Trump’s protectionist trade policy, marketed as a strong assertion of American sovereignty, now comes under extreme scrutiny with forecasts of a recession that would have profound ripple effects worldwide. With the recession warning signs blinking and tensions in trade escalating, the threats to the world economy have seldom been greater.

Recession now on the front-burner. Financial leaders have blown the alarm whistle in uncharacteristic alarm. Moody’s Analytics, one of the nation’s leading econometric forecasters, increased the likelihood that the nation would slip into recession to 35%—a level that the nation’s top economist Mark Zandi characterized as “uncomfortably high and rising.” Goldman Sachs in a recent report adjusted the likelihood from 15% to 20% based on rising uncertainties. J.P. Morgan Chase economists placed the likelihood at 40% within the year based on “extreme U.S. policies,” Bloomberg reported.

These prognostications are based on the ominous alignment of indicators. The U.S. stock market has collapsed, losing billions of dollars in value since the news about tariffs. Consumer confidence, the prime spur for prosperity, has soured as families prepare for the worst. Lately there have also been disappointments in the latest labour report that the jobs market itself is losing strength—a leading indicator. By dictionary definition—two consecutive quarters of falling inflation-adjusted GDP—the U.S. may be on the edge.

“We’ve gone from something that was low-probability in January to something that’s now actual risk within the next few weeks,” says Stephan Weiler, economics professor at Colorado State University and one-time Federal Reserve research officer. “Recession’s the word on everyone’s lips these days—no longer just in the U.S. The world is up and taking notice.”

Tariff Trigger: Trump’s Move into the Dark Side

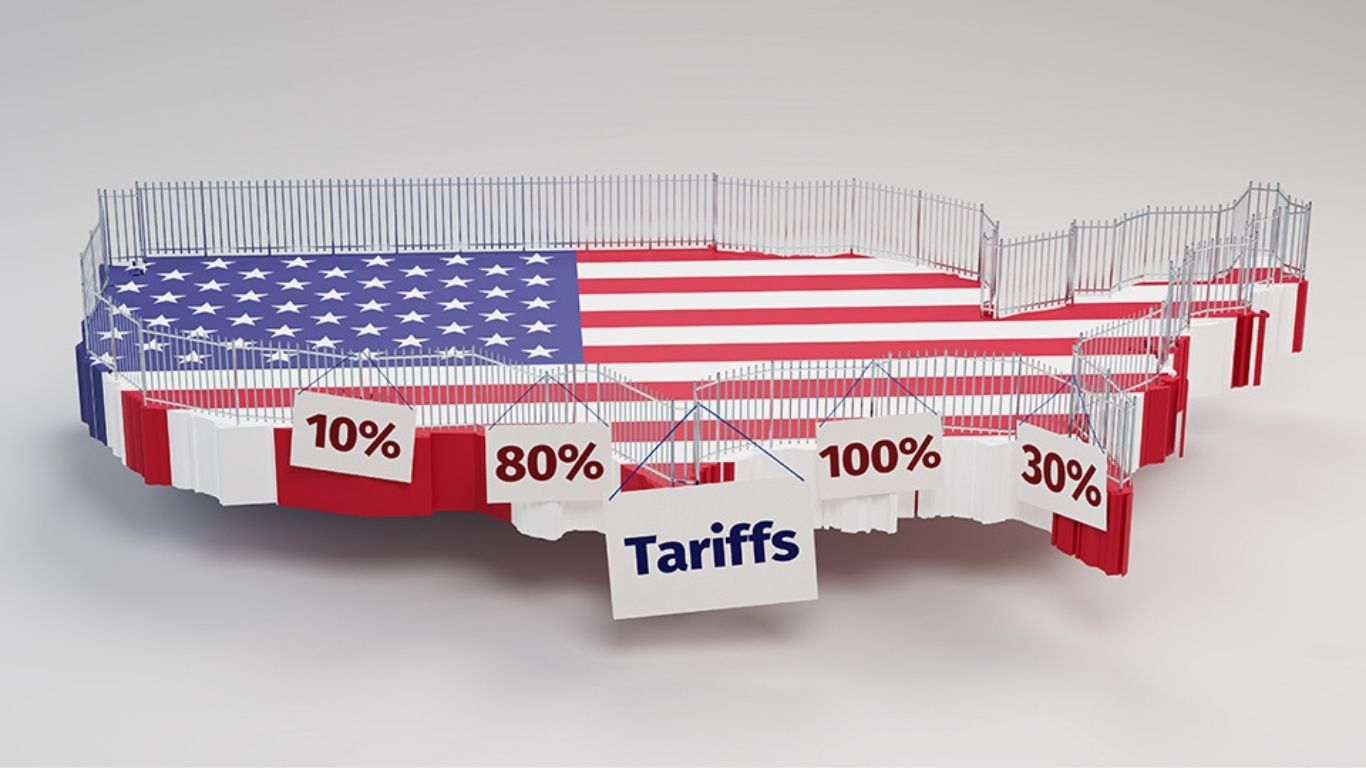

At the epicenter of all this economic storming is the Trump administration’s aggressive trade agenda. The U.S. imposed last week tariffs on imports from Mexico and Canada at the rate of 25% and tariffs on Chinese imports at the rate of 10%—following up on the first round that kicked in in February. Purported purpose: Punish nations Trump holds responsible for the facilitation and shipment of illegal drugs into the U.S., and reward domestic enterprise. And the execution was chaotic. Followed up on the announcement were the delay in tariffs on Mexico-Canada related automobiles for one month and the delay in tariffs on USMCA-compliant goods—a free trade agreement signed between the U.S., Canada, and Mexico to stabilize North American trade.

The breather did little to stop the damage. Canada responded by taxing U.S. farm products and China hit U.S. equipment and soybeans in escalating the trade war between the two largest economies in the world. Global markets have been shaken by the tit-for-tat retort that saw the Dow Jones Industrial Average plummet by more than 1,000 points in one day—a flashback in trade panics.

Trump positions what he’s doing as necessary rebalancing. In a Sunday Fox News interview, he acknowledged that tariffs would create “a period of transition” but dismissed the specter of recession as premature. “I hate to predict things like that,” he said, taped several days ago. “It will take time, but I think that it’ll be great for us.” On social media earlier this month, he doubled down, positioning the tariffs as a shield against drug running and unfair trade practices. In the joint session of Congress last week, he denounced Canada and China for their tariffs on U.S. goods, vowing “to level the playing field.”

The White House reaffirmed the determination. “President Trump continues to prove that he remains committed to ensuring U.S. trade policy promotes the national interest,” the statement said. To most economists, the strategy threatens to blow up in spectacular fashion.

The Domino Economic Effect

The economics of the tariff-induced slump are simple—and grim. Consumer spending that accounts for around 70% of U.S. GDP might erode as households spooked by inflation and layoffs cinch up. “People don’t spend when they’re afraid,” says Olu Sonola, the head of U.S. regional economics at Fitch Ratings. “They save for the worst-case scenario.”

15% of GDP companies that represent might do the same by paring investments as supply chains freeze up and export markets shrink. “That’s the worst fear,” says Sonola. “Uncertainty kills confidence.”

It would have worldwide implications. An American slowdown would devastate Europe’s and Asia’s exporters who exist and breathe the U.S. demand. Canada and Mexico, locked into the U.S. by the USMCA, are doubly cursed: retaliatory tariffs hurt them economically and the weaker U.S. economy would chop into their exports. China, already burdened by domestic debt, would have growth hit harder still, bringing down the commodity-based economies like Australia and Brazil. Free trade-dependent emerging economies would experience currency crises as funds flee into havens.

There’s the human cost in the waiting. “Recessions are bad,” cautions Zandi. “People lose work, income, and assets.” In the US, the first round of layoffs would unleash a self-reinforcing downward spiral: companies retrench, consumers pull in their belts and reduce spending, and growth slows. It would be survival decisions for the vulnerable: rent or groceries or fill up the tank? Globally, the world’s poorest nations would experience food shortages and instability as trade disruptions take root.

A Geopolitical Powder Keg

Beyond economics, Trump’s tariffs are deeply diplomatic in nature. Blackening Canada and Mexico—friends—has strained North American unity at the very moment when Russia and China are looking for the upper hand among geopolitical rivals. Beijing in particular can capitalize on the chaos and position itself as the voice of stability in world trade even as Beijing strikes back at Washington. The European Union, temporarily kept out of immediate tariffs, watches anxiously, as leaders there weigh giving themselves over to either the U.S. side or striking out alone.

Trump’s bombast stokes the flames. His most recent speech on the Hill pitted Canada and China as trade rivals, another approach that would further solidify the divisions. His drug-induced logic—connecting tariffs and the fentanyl epidemic—rings among the domestic base that’s fatigued by the border. It’s a risk: stoke the allies for political capital, wagering that the U.S. economy can ride out the storm.

What the Future Holds

Its outcome is still in doubt. Recession is not inevitable—yet. Everything depends on whether Trump doubles down on tariffs or chooses the negotiating route. Démilitarization with China, even by restored trade agreement, would calm markets. Tariffs rollback on Canada and Mexico would save North American stability. Signs point otherwise. Trump’s refusal to rule out the prospect of recession, along with his commitment to being “winning” trade wars, suggests there might yet be more fight.

To the average citizen, the danger lurks close by. Recession would strain budgets, shut companies, and swell the U.S. national debt—already a politically charged powder keg. Overseas, the shock would decimate economies and reshape the balance of global power. “It’s anybody’s guess where this lands,” says Sonola. “The threat is there, and it’s not one that’s solely America’s alone.” While markets twist and foreign policy experts run around helter-skelter, one thing is certain: Trump’s tariffs have taken the world economy into new territory. The world holds its breath and watches if this is a storm blown by or the harbinger of something worse.